How to Exchange Maker (MKR)

Exchange MKR instantly

Swap Maker (MKR) in a few clicks on Exchang.io.

Registration and limits free service.

Historical Price Chart

Maker Current Market Data

| Name | Maker |

|---|---|

| Price | $2,017.11 |

| Price Change 24h | -2.18% |

| Price Change 7d | 3.15% |

| Price Change 30d | 26.58% |

| Price Change 60d | 35.73% |

| Market Cap | $1,860,215,066.54 |

| Circulating Supply | 922,217.23 MKR |

| Volume 24h | $56,061,458.46 |

How to Exchange Maker in Just a Few Straightforward Steps

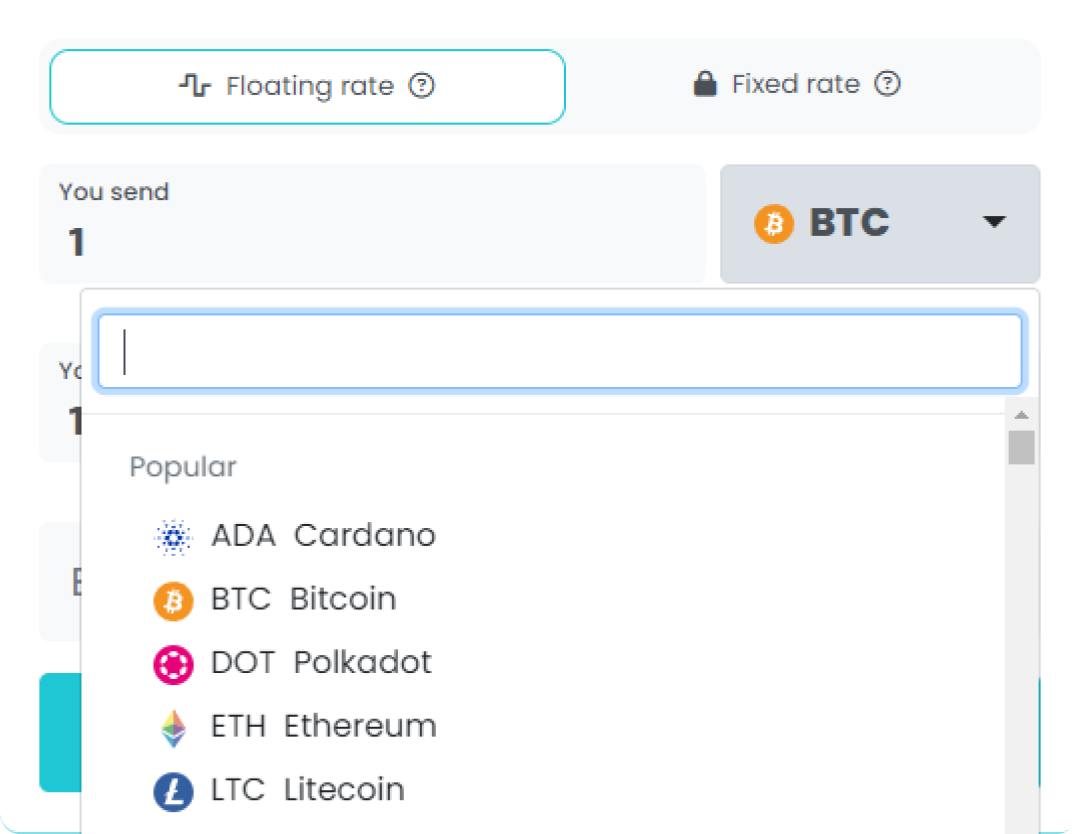

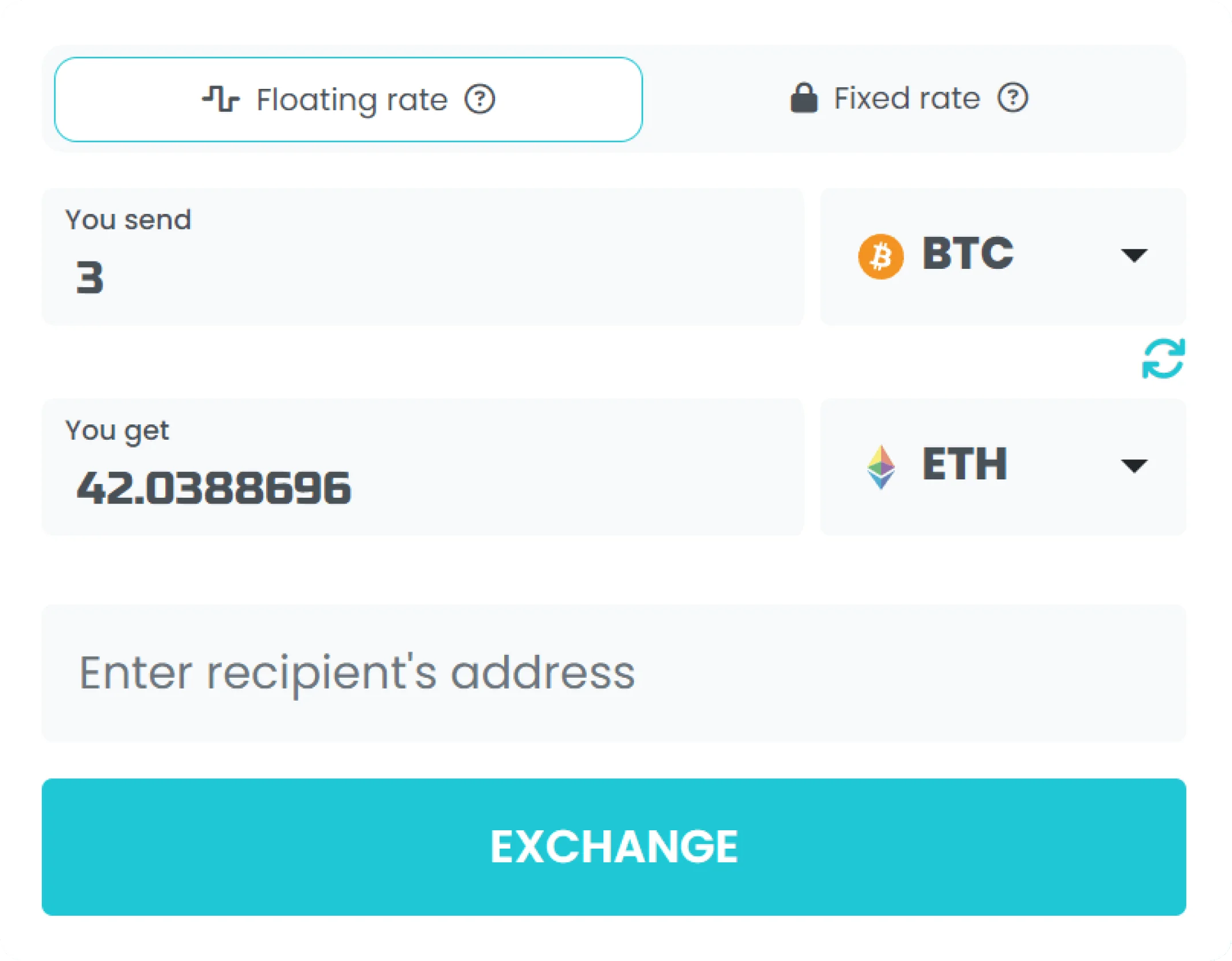

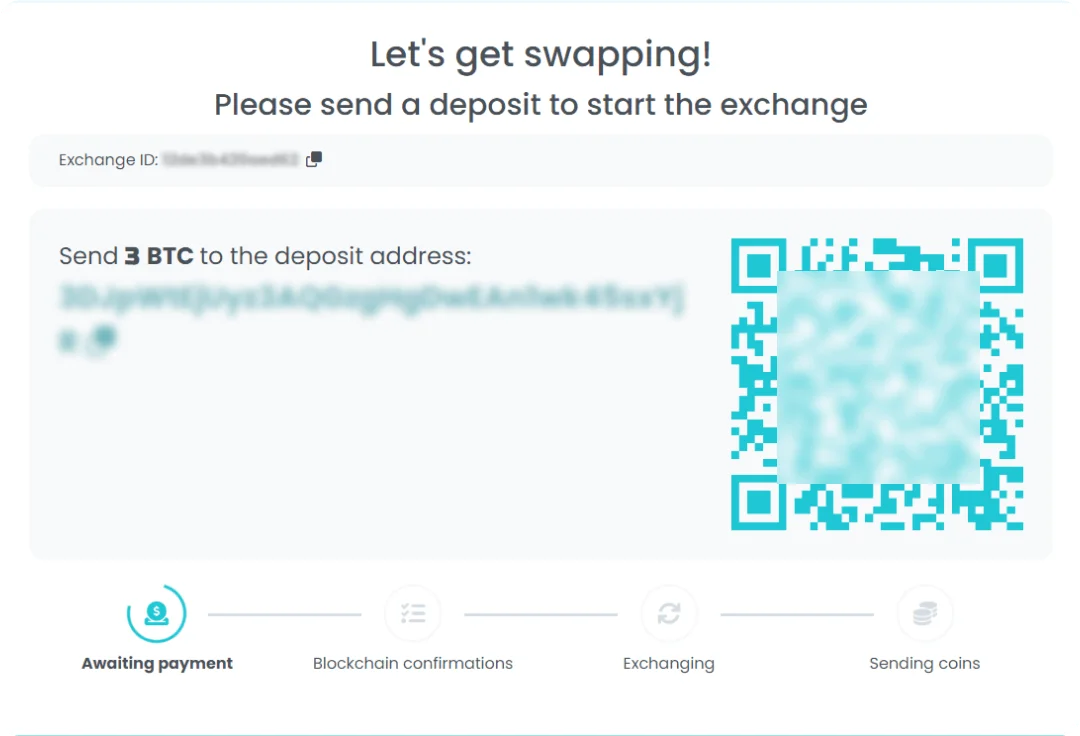

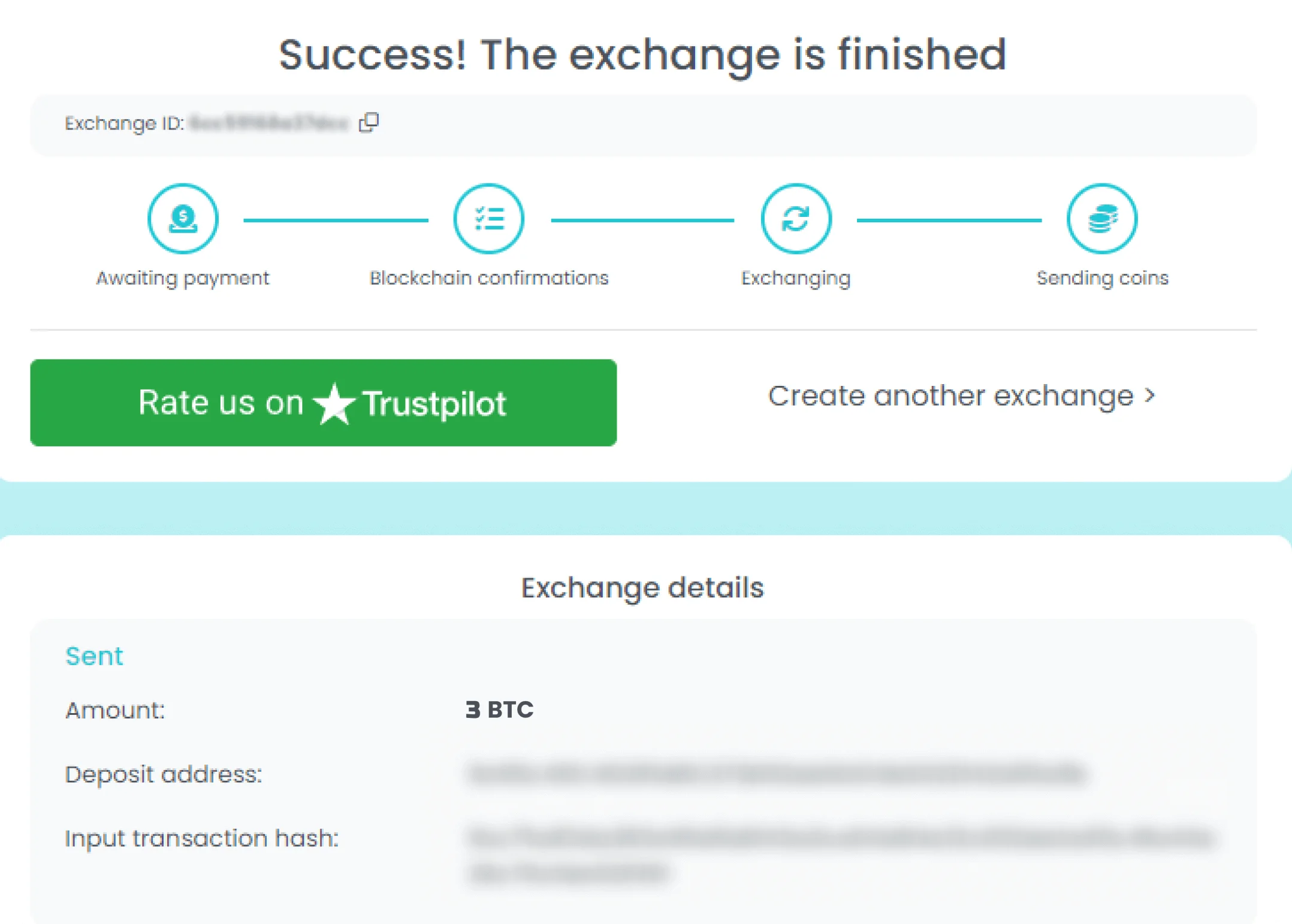

If you are looking to MKR exchange, you are in the right place. Swap Maker in a matter of minutes using Exchang.io crypto exchange. Just adhere to these 4 simple steps.

Benefits of Exchanging MKR on Exchang.io

Simple

We make sure not to overload our website with unnecessary elements. Only the things you need for smooth Maker conversions.Simple and clear.

Secure

Exchang.io is a safest place to exchange MKR. Get MKR anonymously, without KYC and registration.

In touch

Write to us in any unclear situation with MKR swaps. Our support team is happy to help you 24/7.

Fast

We are constantly upgrading our platform to make Maker exchanges really fast. The average speed for the swap is about 5-15 minutes.Popular Maker trading pairs

Here are some popular MKR trading pairs. You can buy MKR with every listed coin on Exchang.io.

How Much Maker Can I Exchange on Exchang.io?

Exchanging Maker on Exchang.io is unlimited. You can start swapping MKR right now starting from the lower limit of ≈ $3.

There are no upper limits for Maker exchanges at Exchang.io. Exchange Maker with other cryptocurrencies from the list of over 700 coins as much as you want to.

Cross-chain exchanges are available; just choose any coin on any network and click the Exchange button, and we'll do the rest for you

Why exchange Maker?

Things you will be able to do with exchanged MKR:

With your Maker cryptocurrency, you can engage in a variety of activities. Firstly, you can use Maker to participate in decentralized finance (DeFi) protocols and earn interest on your holdings by lending or providing liquidity. Additionally, Maker can be used as a governance token, allowing you to vote on proposals and influence the direction of the Maker ecosystem. Furthermore, you can buy and sell Maker on various exchanges, taking advantage of price fluctuations for potential profits. Lastly, you can store your Maker tokens securely in a cryptocurrency wallet, ensuring the safety of your assets while maintaining control over your private keys.

What is Maker?

Maker is a decentralized autonomous organization (DAO) that operates on the Ethereum blockchain. It is the native cryptocurrency of the Maker protocol, which aims to enable the creation and governance of the stablecoin Dai. Maker's primary function is to serve as collateral for generating Dai through smart contracts.

Unlike many other cryptocurrencies, Maker is not designed primarily for transactions or as a medium of exchange. Its purpose is to support the stability and value of the Dai stablecoin. While Maker can be bought and sold on various exchanges, its main utility lies within the Maker protocol ecosystem.

The Maker protocol functions by allowing users to lock their Maker tokens as collateral in a smart contract called a "Vault." By locking Maker tokens, users can generate Dai, which they can then use for various purposes such as borrowing other cryptocurrencies or making purchases.

One key difference between Maker and other cryptocurrencies is its role in governing the Maker protocol. Holders of Maker tokens have voting rights and can participate in decision-making processes related to the protocol. This governance feature sets Maker apart from many other cryptocurrencies, where such decision-making power is often centralized or absent altogether.

Another distinction is the focus on stability rather than price speculation. The Dai stablecoin, generated through the Maker protocol, aims to maintain a 1:1 peg with the US dollar. This stability makes Dai more suitable for everyday transactions and helps mitigate volatility commonly associated with other cryptocurrencies.

When using the Maker protocol, it's essential to have an Ethereum wallet to hold your Maker tokens and interact with the smart contracts. Wallets compatible with Ethereum, such as MetaMask, can be used to send and receive Maker tokens, create Vaults, and engage in governance activities.

It's worth noting that while Maker can be traded on exchanges, its value is tied to the stability and demand for Dai. Therefore, fluctuations in the Dai price can indirectly impact the value of Maker. Additionally, Maker's role as collateral in the Maker protocol means that its value is intrinsically linked to the stability and success of the ecosystem.

In summary, Maker is a cryptocurrency that serves as collateral for generating the stablecoin Dai within the Maker protocol. Its primary purpose is not as a medium of exchange but rather to support the stability of Dai. Maker holders can participate in the governance of the protocol, and using Maker requires an Ethereum wallet. Unlike many other cryptocurrencies, Maker's value is closely tied to the success and stability of the ecosystem it operates within.

Brief History of Maker

Maker (MKR) is a cryptocurrency that was created in 2015 by Rune Christensen. It is the native token of the MakerDAO platform, which operates on the Ethereum blockchain. The purpose of MakerDAO is to provide a decentralized stablecoin called Dai (DAI), which is pegged to the value of the US dollar. MKR plays a crucial role in governing the MakerDAO system and maintaining the stability of Dai.

The MakerDAO platform allows users to generate Dai by locking their Ethereum as collateral. This process involves creating a collateralized debt position (CDP), where users can borrow Dai against their locked ETH. To ensure the safety and stability of the system, MKR holders participate in the decision-making process regarding key parameters such as interest rates and collateral requirements. They also act as a backstop in case the system faces insolvency issues.

MKR has gained recognition for its innovative approach to stablecoin creation and governance. Unlike centralized stablecoins, such as Tether (USDT) or USD Coin (USDC), Dai is not backed by traditional assets held in a bank account. Instead, it relies on overcollateralization and smart contract mechanisms to maintain its value. This decentralized design makes Dai more censorship-resistant and less susceptible to single points of failure.

In terms of exchanges, MKR is listed on various cryptocurrency exchanges, including Binance, Coinbase Pro, and Kraken. These exchanges provide a platform for users to buy, sell, and trade MKR tokens. It's essential to note that the price of MKR can fluctuate due to market dynamics, supply, and demand factors, just like any other cryptocurrency. Therefore, users should exercise caution and conduct thorough research before engaging in MKR transactions.

Holding MKR tokens can be beneficial for users who actively participate in the MakerDAO ecosystem. MKR holders have voting rights, enabling them to influence the platform's governance decisions. Additionally, MKR is used as a mechanism to manage the stability fees charged on CDPs and facilitate debt auctions in case of undercollateralization. These various utilities contribute to the overall value proposition of MKR.

To store MKR, users can utilize Ethereum-compatible wallets that support ERC-20 tokens. Examples of popular wallets include MetaMask, MyEtherWallet, and Ledger. It's crucial to choose a reliable and secure wallet to ensure the safety of MKR tokens. Best practices for wallet security include using hardware wallets, enabling two-factor authentication, and keeping private keys offline.

In conclusion, Maker (MKR) cryptocurrency was created as the native token of the MakerDAO platform. It plays a crucial role in governing the system and maintaining the stability of Dai. MKR holders have voting rights and participate in decision-making processes. MKR can be bought, sold, and traded on various exchanges. Users should be aware of the price volatility and conduct thorough research before engaging in transactions. Storing MKR requires an Ethereum-compatible wallet, with security measures being of paramount importance. The innovative design and utilities of MKR contribute to its overall value proposition within the cryptocurrency ecosystem.

Maker Key Advantages and Unique Features

Maker cryptocurrency, also known as MKR, is a decentralized platform built on the Ethereum blockchain that offers various unique features and advantages. MKR is a governance token that powers the MakerDAO ecosystem, which includes the stablecoin DAI. Here are some key advantages and unique features of Maker cryptocurrency.

MKR provides decentralized governance, allowing token holders to participate in decision-making processes regarding the development and management of the platform. This ensures that the community has a say in important matters, such as system upgrades and collateral types.

One of the core features of Maker is its ability to generate DAI, a stablecoin pegged to the US dollar. Users can lock up their crypto assets as collateral in a smart contract called a "Vault" and generate DAI against it. This feature enables users to access liquidity without selling their underlying assets, making it useful for various financial purposes.

The stability of DAI is maintained through a mechanism called the Maker Protocol. It utilizes a combination of overcollateralization, automatic liquidations, and interest rates to keep DAI's value stable. This stability allows users to confidently use DAI for transactions or as a store of value.

Maker's decentralized exchange, OasisDEX, provides users with a secure and transparent platform to trade cryptocurrencies. With OasisDEX, users have control over their funds, reducing the risk of hacks or theft associated with centralized exchanges. The platform also supports trading pairs involving MKR, enhancing liquidity for the token.

Another notable advantage of Maker is its integration with other DeFi protocols and services. The Maker Protocol serves as a backbone for several lending platforms, enabling users to utilize their generated DAI in a wide range of applications within the DeFi ecosystem. This interoperability enhances the utility and flexibility of Maker.

Additionally, MKR holders can participate in the MakerDAO's voting system to influence changes to the platform's parameters, such as stability fees and collateral types. This governance feature gives MKR token holders a direct say in the development and evolution of the platform.

Moreover, Maker's smart contract infrastructure ensures that transactions on the platform are transparent and secure. The use of blockchain technology enables immutability, reducing the risk of fraud or tampering. Users can track their transactions and verify them on the Ethereum blockchain.

Another unique aspect of Maker is its ability to incentivize users through the Stability Fee mechanism. MKR holders can benefit from stability fees paid by borrowers who generate DAI against their collateral. This provides an opportunity for MKR holders to earn passive income on the platform.

MKR also offers integration with various wallets, allowing users to securely store and manage their tokens. This integration enhances user experience and accessibility, making it easier for individuals to interact with the Maker ecosystem.

10 Facts About Maker

- Maker (MKR) is a decentralized cryptocurrency built on the Ethereum blockchain that powers the MakerDAO ecosystem.

- MKR serves as the governance token for the MakerDAO platform, allowing holders to participate in decision-making processes and vote on important protocol changes.

- The main goal of MakerDAO is to facilitate the creation and management of collateral-backed stablecoins, with Dai (DAI) being the most prominent stablecoin issued on the platform.

- MakerDAO operates as a decentralized autonomous organization (DAO), meaning that it runs on smart contracts and is governed by the community rather than a central authority.

- MKR holders can also earn rewards by staking their tokens in the MakerDAO system and participating in lending and borrowing activities.

- The MakerDAO platform incorporates a unique stability mechanism called the Collateralized Debt Position (CDP), which allows users to lock up collateral such as Ether (ETH) in exchange for issuing DAI stablecoins.

- MKR has gained popularity among cryptocurrency enthusiasts and investors due to its role in maintaining the stability of the DAI stablecoin and participating in the governance of the MakerDAO ecosystem.

- MKR can be bought and sold on various cryptocurrency exchanges, providing liquidity and accessibility to traders looking to invest in or trade the token.

- The price of MKR is determined by supply and demand dynamics on these exchanges, with market forces influencing its value.

- To securely store MKR and other cryptocurrencies, users can utilize digital wallets, which provide a safe and private means of managing their holdings.

Maker (MKR) is a decentralized cryptocurrency used within the MakerDAO ecosystem for governance and stability mechanisms. It can be traded on exchanges, and its price is determined by market dynamics. MKR holders play a crucial role in the management and operations of the platform, while digital wallets offer a secure way to store and manage MKR and other cryptocurrencies.

What is the Best Place to Exchange MKR?

Via Exchang.io service you can effortlessly swap Maker for over 700+ different assets. Begin by selecting MKR and your desired coin, paying attention to the network when making your choice. Next, provide the recipient's wallet address for the coin you're swapping to, and press 'Exchange' to continue. Deposit the required amount of MKR to the address displayed on the screen, ensuring you have the necessary amount to finalize the transaction. Once completed, check your wallet to confirm the arrival of your newly acquired coin. Exchang.io makes exchanging Maker simple and convenient, allowing you to enjoy a seamless experience with an extensive selection of coins to choose from.

Do I need to create an account on Exchang.io to swap Maker?

No, you don't need to create an account or provide any personal information to exchange Maker on Exchang.io. The platform is registration-free and does not require any ID verification. Simply follow the simple steps to buy Maker using your cryptocurrency.

How long does it take to exchange Maker on Exchang.io?

The exchange process on Exchang.io is typically very fast and can be completed in just a few minutes. The actual time may vary slightly depending on network traffic and transaction confirmation times.

What is the minimum amount needed to swap MKR on Exchang.io?

There is a minimum amount required for exchanging MKR on Exchang.io. However, please note that this minimum amount may change over time. It is recommended to check the platform for the latest requirements.

Is Exchang.io legit? Why should I trust Exchang.io?

Exchang.io is a legitimate platform operated by a team of experienced crypto enthusiasts with over 7 years of industry experience. The platform's main goal is to provide a convenient, fast, and transparent service to its users. They value feedback from the community and continuously strive to improve their services. You can check reviews on Exchang.io.com to get an idea of their reputation.

What are some popular MKR trading pairs?

Popular MKR trading pairs on Exchang.io include MKR/BTC, MKR/ETH, MKR/LTC, and MKR/USDT, among others. These trading pairs allow you to exchange Maker for other cryptocurrencies or vice versa.

Are cross-chain exchanges available for Maker?

Yes, Exchang.io supports cross-chain exchanges for Maker. You can choose any coin on any network, click the 'Exchange' button, and Exchang.io will handle the rest. This allows you to swap Maker between different blockchains seamlessly.