How to Exchange StaFi (FIS)

Exchange FIS instantly

Swap StaFi (FIS) in a few clicks on Exchang.io.

Registration and limits free service.

Historical Price Chart

StaFi Current Market Data

| Name | StaFi |

|---|---|

| Price | $0.39 |

| Price Change 24h | -0.30% |

| Price Change 7d | -3.33% |

| Price Change 30d | -6.55% |

| Price Change 60d | 19.95% |

| Market Cap | $23,856,677.42 |

| Circulating Supply | 60,452,000.00 FIS |

| Volume 24h | $2,068,404.79 |

How to Exchange StaFi in Just a Few Straightforward Steps

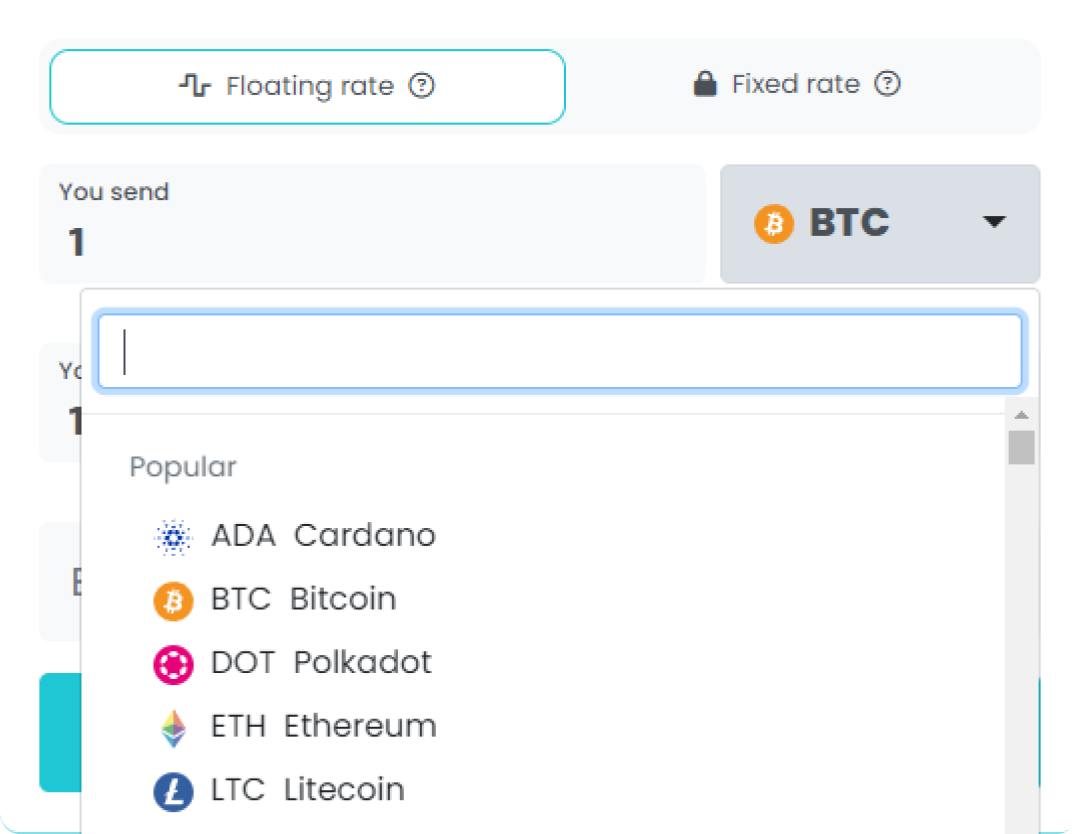

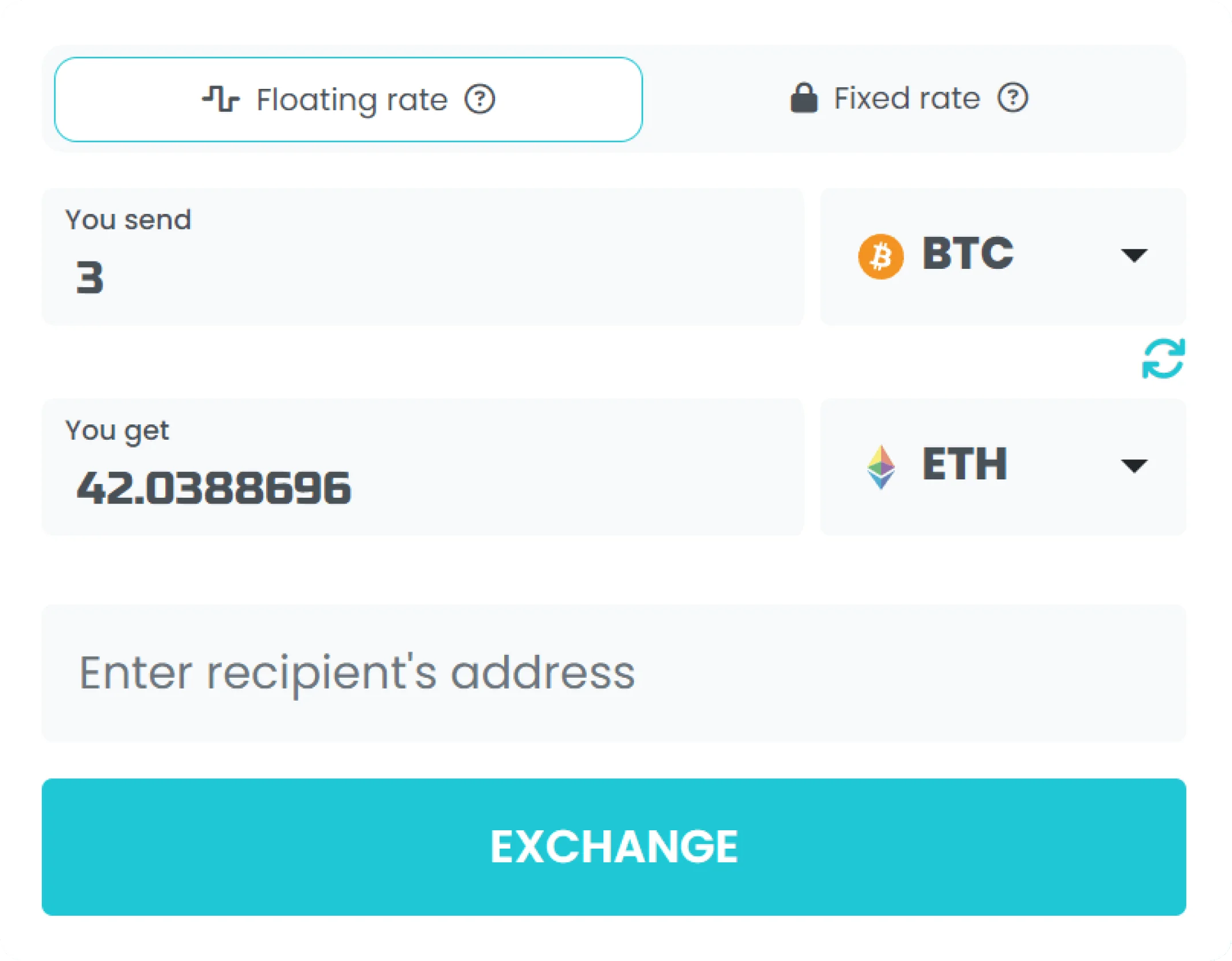

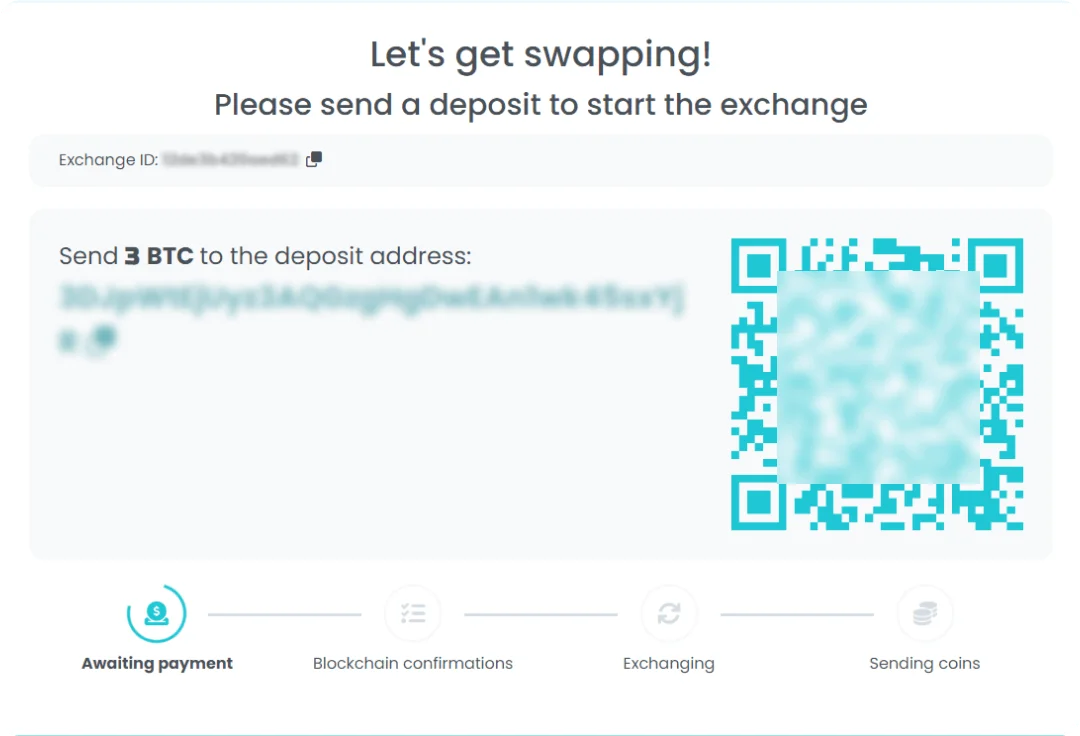

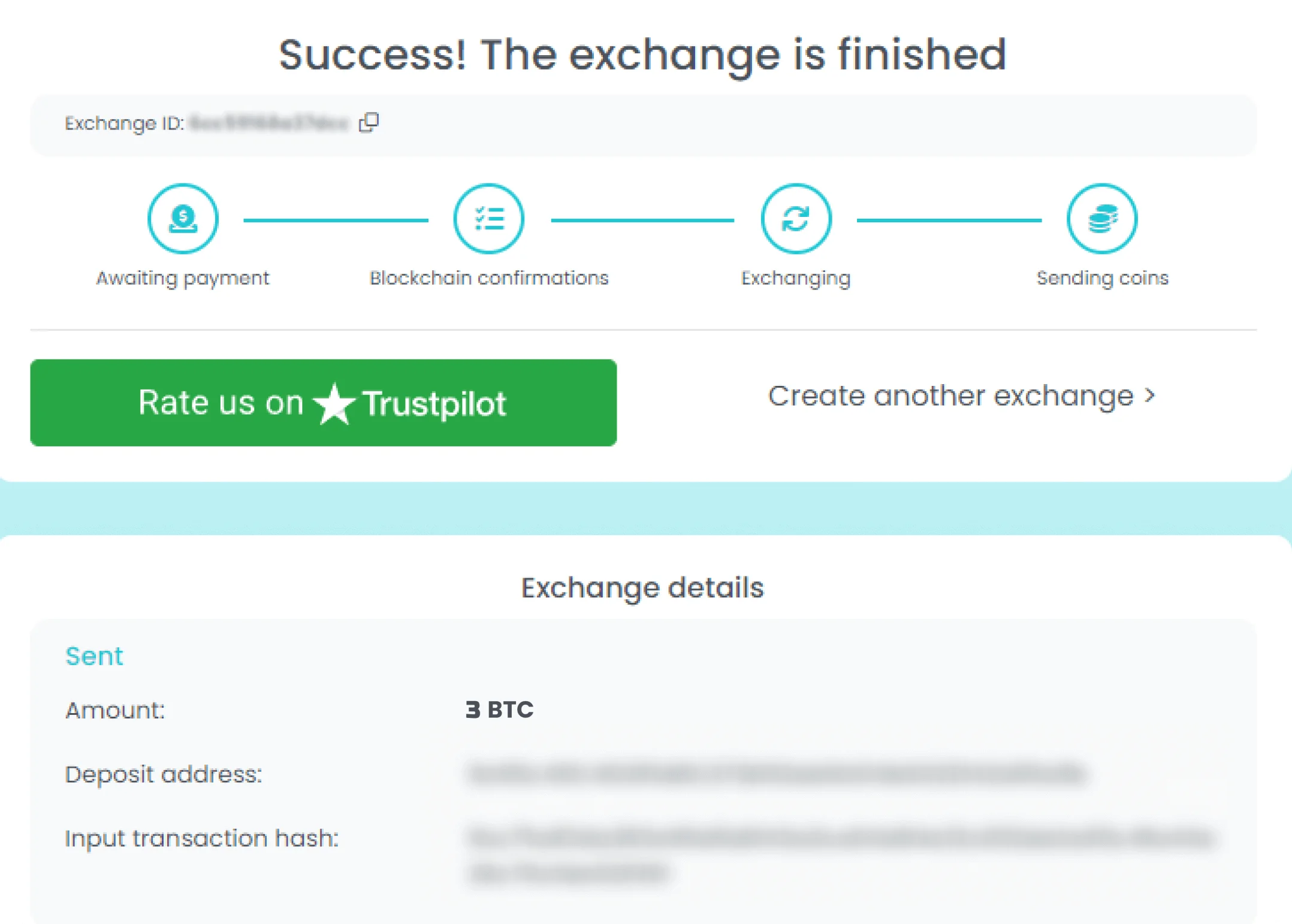

If you are looking to FIS exchange, you are in the right place. Swap StaFi in a matter of minutes using Exchang.io crypto exchange. Just adhere to these 4 simple steps.

Benefits of Exchanging FIS on Exchang.io

Simple

We make sure not to overload our website with unnecessary elements. Only the things you need for smooth StaFi conversions.Simple and clear.

Secure

Exchang.io is a safest place to exchange FIS. Get FIS anonymously, without KYC and registration.

In touch

Write to us in any unclear situation with FIS swaps. Our support team is happy to help you 24/7.

Fast

We are constantly upgrading our platform to make StaFi exchanges really fast. The average speed for the swap is about 5-15 minutes.Popular StaFi trading pairs

Here are some popular FIS trading pairs. You can buy FIS with every listed coin on Exchang.io.

How Much StaFi Can I Exchange on Exchang.io?

Exchanging StaFi on Exchang.io is unlimited. You can start swapping FIS right now starting from the lower limit of ≈ $3.

There are no upper limits for StaFi exchanges at Exchang.io. Exchange StaFi with other cryptocurrencies from the list of over 700 coins as much as you want to.

Cross-chain exchanges are available; just choose any coin on any network and click the Exchange button, and we'll do the rest for you

Why exchange StaFi?

Things you will be able to do with exchanged FIS:

With StaFi cryptocurrency, you can stake your tokens to earn rewards for helping secure the network. Staking involves locking up a certain amount of tokens in a validator node, which helps validate transactions and maintain the network's integrity.

You can also use StaFi to participate in governance decisions for the network. This means that you can vote on changes to the network protocol, such as implementing new features or adjusting transaction fees.

StaFi can be used to pay for goods and services at merchants who accept cryptocurrency payments. As more businesses begin to accept cryptocurrencies, including StaFi, it becomes easier to use digital currencies in everyday life.

Finally, you can trade StaFi on various cryptocurrency exchanges. This allows you to buy and sell StaFi tokens for other cryptocurrencies or fiat currencies, potentially generating profits through trading strategies like buying low and selling high.

What is StaFi?

StaFi is a decentralized finance (DeFi) platform that offers users the ability to stake and trade their tokens securely. The platform provides a range of services, including staking-as-a-service (STaaS), liquidity provision, and yield farming. StaFi aims to bridge the gap between locked-up assets and liquid assets in the DeFi ecosystem.

StaFi uses a unique token model that separates the staked and liquid value of an asset. Users can stake their tokens on the platform, which are then converted into rTokens, representing the locked-up value. These rTokens can be traded or used as collateral for loans while the original tokens remain staked.

One of the main benefits of StaFi is its ability to allow users to earn staking rewards without having to worry about lock-up periods. The platform also provides users with access to a wide range of DeFi applications through its partnership with other protocols.

The StaFi protocol uses a Proof-of-Stake (PoS) consensus mechanism, which is more energy-efficient than the Proof-of-Work (PoW) consensus used by Bitcoin. This allows for faster transaction times and lower fees compared to traditional blockchain networks.

The native token of the StaFi network is called FIS. It is used to pay for transaction fees and acts as a governance token, allowing holders to vote on proposals related to the future development of the platform. FIS can also be staked on the platform to earn rewards.

StaFi was founded in 2019 by a team of blockchain experts and has received support from various investors and venture capital firms. The platform has undergone several audits to ensure its security and reliability, and it has maintained a strong track record of uptime and stability.

Overall, StaFi aims to provide a user-friendly platform for staking and trading cryptocurrencies, with a focus on liquidity and accessibility. By allowing users to earn rewards without lock-up periods, StaFi aims to facilitate the growth of the DeFi ecosystem and make it more accessible to a wider audience.

In addition to staking, users can also provide liquidity to earn rewards through the StaFi rETH and rDOT pools. These pools allow users to earn yield by providing liquidity for Ethereum and Polkadot tokens, respectively.

The protocol is built on Ethereum and integrates with other DeFi protocols like Curve, Uniswap, and Balancer. This allows for seamless integration with the wider DeFi ecosystem and provides users with access to a wide range of applications and services.

StaFi has a strong community of developers and supporters who are actively working on expanding the platform's capabilities and improving its user experience. The team regularly communicates with users through social media channels and other platforms, keeping them informed about new developments and updates.

The platform's security and reliability are ensured through a system of smart contracts and regular audits by third-party security firms. These measures help to protect users' funds and ensure the integrity of the platform.

One of the key features of StaFi is its ability to lock up assets from different blockchains. This means that users can stake assets from a variety of chains, including Ethereum and Polkadot, and then convert them into rTokens for use within the StaFi ecosystem.

The StaFi platform is designed to be scalable and capable of handling a large volume of transactions. This scalability is achieved through the use of sharding, which allows for parallel processing of transactions and improved network efficiency.

Overall, StaFi represents a promising solution to the challenges facing the DeFi ecosystem, offering users greater accessibility and liquidity while maintaining high levels of security and reliability. As the platform continues to evolve and grow, it is likely to become an increasingly important player in the DeFi space.

Brief History of StaFi

StaFi, short for Staked Finance, is a decentralized finance (DeFi) project that aims to solve the liquidity problems associated with staking. It was founded in 2020 by a team of blockchain experts led by Yubo Ruan and has its headquarters in Singapore.

The StaFi protocol allows users to stake their cryptocurrency assets while also providing them with liquidity through tokenization. This process involves locking up the underlying assets and issuing tokens on a one-to-one basis. These tokens can be freely traded, used as collateral or swapped for other assets, providing users with flexibility and increased liquidity.

The FIS token is the native cryptocurrency of the StaFi platform. It serves as the governance token, giving holders the right to vote on proposals and changes to the protocol. FIS was launched through an initial exchange offering (IEO) on Gate.io in March 2021, raising $3.5 million in funding.

The first product launched on the StaFi platform was rToken, which enables users to stake their Ethereum (ETH) and receive rETH tokens in return. These tokens can then be traded on various decentralized exchanges (DEXs) such as Uniswap and SushiSwap. StaFi has since added support for other cryptocurrencies such as Binance Coin (BNB) and Polkadot (DOT).

In May 2021, StaFi announced the launch of its mainnet, allowing users to use the protocol without any restrictions or limitations. This milestone marked a significant step forward for the project and demonstrated its commitment to building a robust and secure DeFi ecosystem.

One of the unique features of StaFi is its "liquid staking" mechanism, which allows users to unstake their assets at any time and immediately receive liquidity in the form of fungible tokens. This eliminates the long lock-up periods associated with traditional staking and provides users with greater flexibility.

In June 2021, StaFi announced a partnership with Polygon (previously Matic Network), a leading layer-2 scaling solution for Ethereum. The partnership aims to bring increased liquidity and accessibility to the StaFi platform by leveraging Polygon's fast and low-cost infrastructure.

In August 2021, StaFi launched its first decentralized application (dApp), called "rBridge," which allows users to transfer assets between different blockchain networks seamlessly. The rBridge dApp supports transfers between Ethereum, Binance Smart Chain, and Polkadot.

Later that same month, StaFi announced a partnership with CertiK, a leading blockchain security audit firm. The partnership aims to enhance the security of the StaFi platform by conducting regular security audits and penetration testing.

In September 2021, StaFi introduced its second product, called "StaFi rFIS." This product allows users to stake their FIS tokens and earn staking rewards without having to lock up their tokens for an extended period.

In October 2021, StaFi launched its third product, "StaFi rDOT," which enables users to stake their DOT tokens and receive rDOT tokens in return. These tokens can then be traded on various DEXs, providing users with increased liquidity.

Overall, StaFi has made significant progress since its launch, building a comprehensive DeFi ecosystem that provides users with increased liquidity, flexibility, and security. With the launch of its mainnet, partnerships with leading projects in the space, and multiple products now available, StaFi is well-positioned to continue growing and establishing itself as a major player in the DeFi ecosystem.

However, as with all cryptocurrency projects, there are risks involved, including regulatory uncertainty, security vulnerabilities, and market volatility. It will be important for StaFi to continue to prioritize risk management and security to ensure the long-term success of its platform.

StaFi Key Advantages and Unique Features

StaFi (Staking Finance) is a cryptocurrency project that aims to provide a solution for liquidity and tradability issues faced by stakers. The platform allows users to stake their tokens and receive rTokens (representative tokens) in return, which can be traded on various decentralized exchanges (DEXs) without having to unstake the original tokens.

One key advantage of StaFi is its ability to provide a liquid market for staked tokens, enabling users to earn rewards from staking while still being able to access their funds. This eliminates the need for users to choose between locking up their assets for a period of time or sacrificing potential gains.

Another unique feature of StaFi is its ability to support multiple staking networks on a single platform. This means that users can stake different tokens across different networks using the same wallet address, simplifying the staking process and reducing the need for multiple wallets.

Additionally, StaFi offers a range of staking options with varying lock-up periods and reward rates to cater to different user preferences. The platform also provides incentives for early adopters and validators, further encouraging participation in the network.

StaFi also incorporates a governance system that allows token holders to vote on important decisions related to the platform's development and management. This ensures a decentralized and community-driven approach to decision-making, aligning with the core principles of blockchain technology.

To ensure security and transparency, StaFi utilizes a Proof-of-Stake (PoS) consensus algorithm, which requires validators to stake a certain amount of tokens as collateral to participate in the network. This incentivizes validators to act in the best interests of the network and reduces the risk of centralization.

Furthermore, StaFi has implemented a slashing mechanism to penalize validators who engage in malicious behavior, such as double-signing or censorship. This helps to maintain the integrity of the network and ensures that bad actors are held accountable for their actions.

In terms of scalability, StaFi has the ability to support a high volume of transactions with fast confirmation times, thanks to its use of Layer-2 scaling solutions. This ensures that users can transact quickly and efficiently, without having to wait for long confirmation times or pay high transaction fees.

Another notable feature of StaFi is its focus on interoperability, which allows tokens from different blockchains to be exchanged and used on the platform. This opens up new possibilities for cross-chain applications and facilitates wider adoption of cryptocurrencies.

Finally, StaFi aims to provide a user-friendly and intuitive interface for both stakers and validators, with easy-to-use tools and resources available on the platform. This helps to lower the barrier to entry for new users and encourages wider participation in the network.

Overall, StaFi offers a range of unique features and advantages that make it an attractive option for those looking to stake their tokens and earn rewards while maintaining access to their funds. Its focus on liquidity, interoperability, security, and scalability make it a promising project with significant potential for growth and adoption in the future.

10 Facts About StaFi

StaFi is a decentralized finance platform that aims to unlock the liquidity of staked assets, allowing users to trade them without having to wait for the staking period to end.

The FIS token is StaFi's native cryptocurrency and is used as a means of payment within the ecosystem. It can also be staked to earn rewards.

StaFi offers several products, including rTokens, which are synthetic assets that represent the value of staked tokens. They can be traded on various exchanges and used in DeFi applications.

StaFi also offers liquid staking solutions for popular PoS blockchains such as Ethereum, Cosmos, and Polkadot, allowing users to stake their tokens and receive liquid staking derivatives in return.

The StaFi protocol uses a Proof-of-Stake consensus mechanism, which allows validators to earn rewards for securing the network by staking their FIS tokens.

The StaFi team aims to make staking more accessible and user-friendly for everyone, regardless of technical expertise or the size of their holdings.

StaFi has partnerships with various blockchain projects, including Polygon, Chainlink, and Uniswap, to integrate its technology and provide more liquidity options for users.

The total supply of FIS tokens is capped at 1 billion, with approximately 73% currently in circulation.

In May 2021, StaFi launched its mainnet, marking the beginning of full-scale implementation of its technology and products.

StaFi has received backing from several notable investors, including HashKey Capital, Signum Capital, and LD Capital.

What is the Best Place to Exchange FIS?

Via Exchang.io service you can effortlessly swap StaFi for over 700+ different assets. Begin by selecting FIS and your desired coin, paying attention to the network when making your choice. Next, provide the recipient's wallet address for the coin you're swapping to, and press 'Exchange' to continue. Deposit the required amount of FIS to the address displayed on the screen, ensuring you have the necessary amount to finalize the transaction. Once completed, check your wallet to confirm the arrival of your newly acquired coin. Exchang.io makes exchanging StaFi simple and convenient, allowing you to enjoy a seamless experience with an extensive selection of coins to choose from.

Do I need to create an account on Exchang.io to swap StaFi?

No. Exchang.io is a registration-free service, so you don't need to provide any personal information or create an account to swap StaFi. Simply follow the simple steps and buy StaFi with your crypto.

How long does it take to exchange StaFi on Exchang.io?

The exchange process on Exchang.io is extremely fast and typically takes only a few minutes to complete. However, the actual time taken may vary slightly depending on network traffic and transaction confirmation times.

What is the minimum amount needed to swap fis on Exchang.io?

There is a minimum amount required for fis exchange on the Exchang.io platform. However, please note that this minimum amount may change over time. Therefore, it's recommended to check the platform for the latest requirements.

Is Exchang.io legit? Why should I trust Exchang.io?

Yes, Exchang.io is a trustworthy platform. Its team consists of cryptocurrency enthusiasts with more than 7 years of experience in the industry. The platform's goal is to provide a convenient, fast, and transparent service to its users. To improve the service level, Exchang.io keeps a close eye on the community's feedback through social networks. You can check reviews on Exchang.io to learn more about the platform's legitimacy.

What are some popular fis trading pairs on Exchang.io?

Some popular fis trading pairs on Exchang.io include fis/BTC, fis/ETH, fis/LTC, and fis/USDT, among others.

Are cross-chain exchanges available for StaFi?

Yes, Exchang.io supports cross-chain exchanges for StaFi. You can choose any coin on any network, click the 'Exchange' button, and Exchang.io will handle the rest.