How to Exchange Compound (COMP)

Exchange COMP instantly

Swap Compound (COMP) in a few clicks on Exchang.io.

Registration and limits free service.

Historical Price Chart

Compound Current Market Data

| Name | Compound |

|---|---|

| Price | $55.51 |

| Price Change 24h | 2.24% |

| Price Change 7d | -1.89% |

| Price Change 30d | -9.74% |

| Price Change 60d | 7.02% |

| Market Cap | $447,916,616.67 |

| Circulating Supply | 8,069,668.03 COMP |

| Volume 24h | $33,307,168.59 |

How to Exchange Compound in Just a Few Straightforward Steps

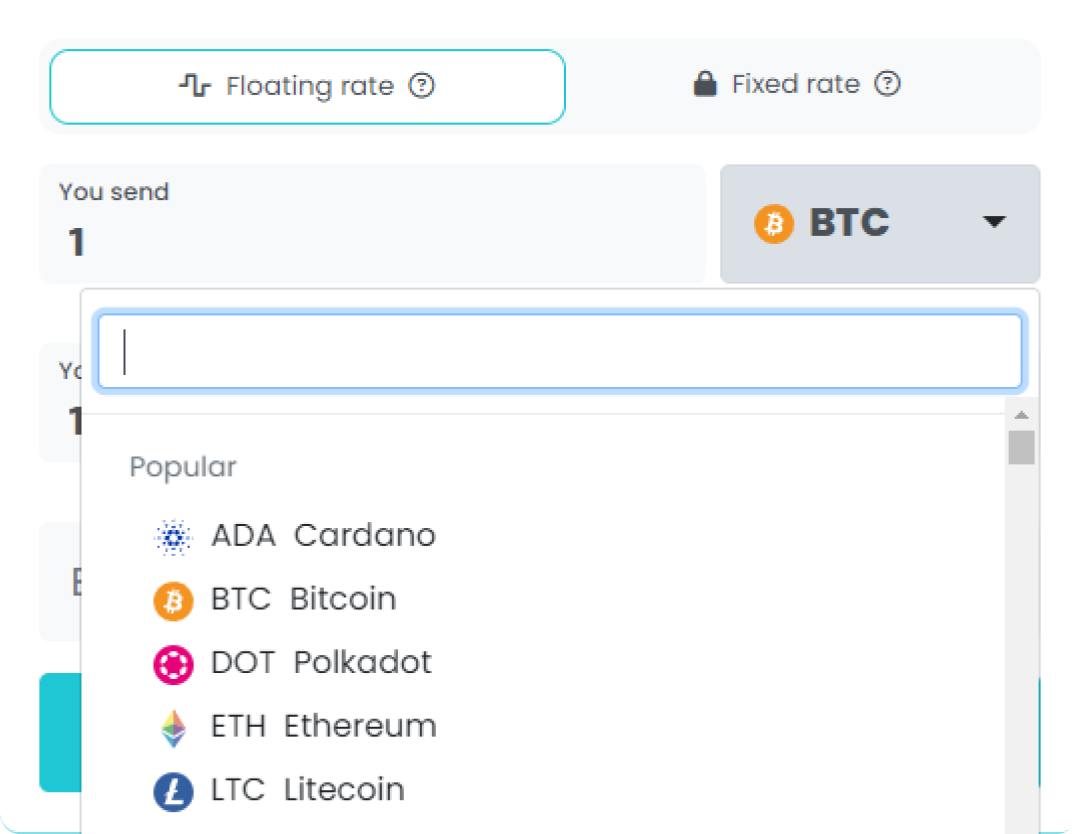

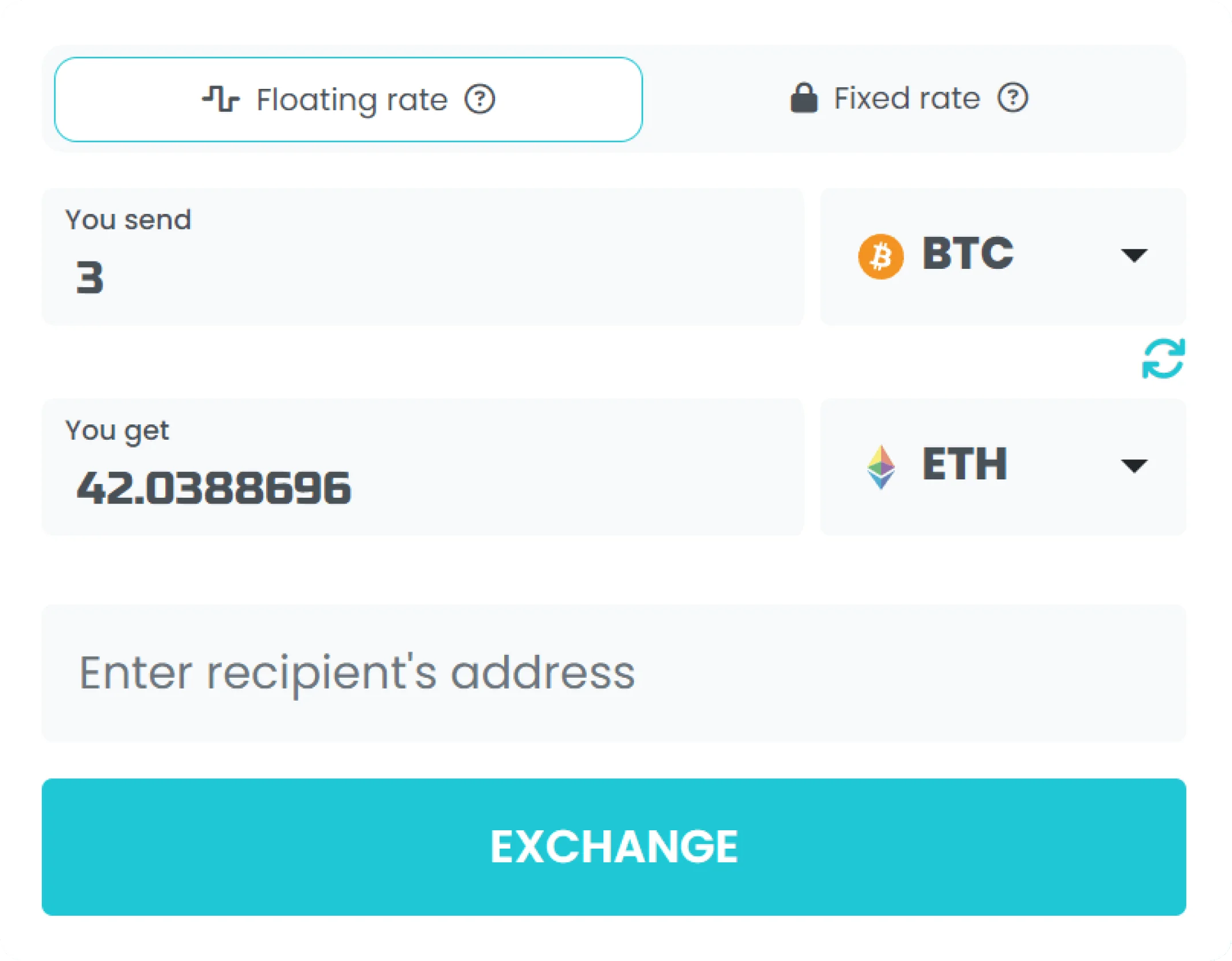

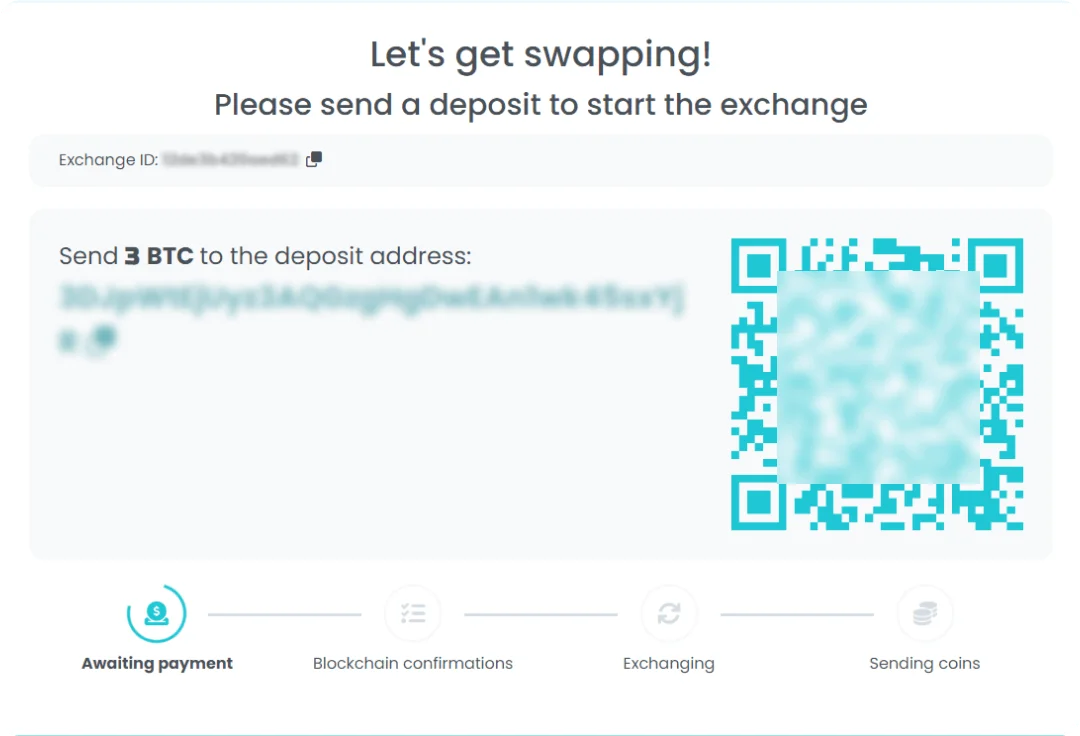

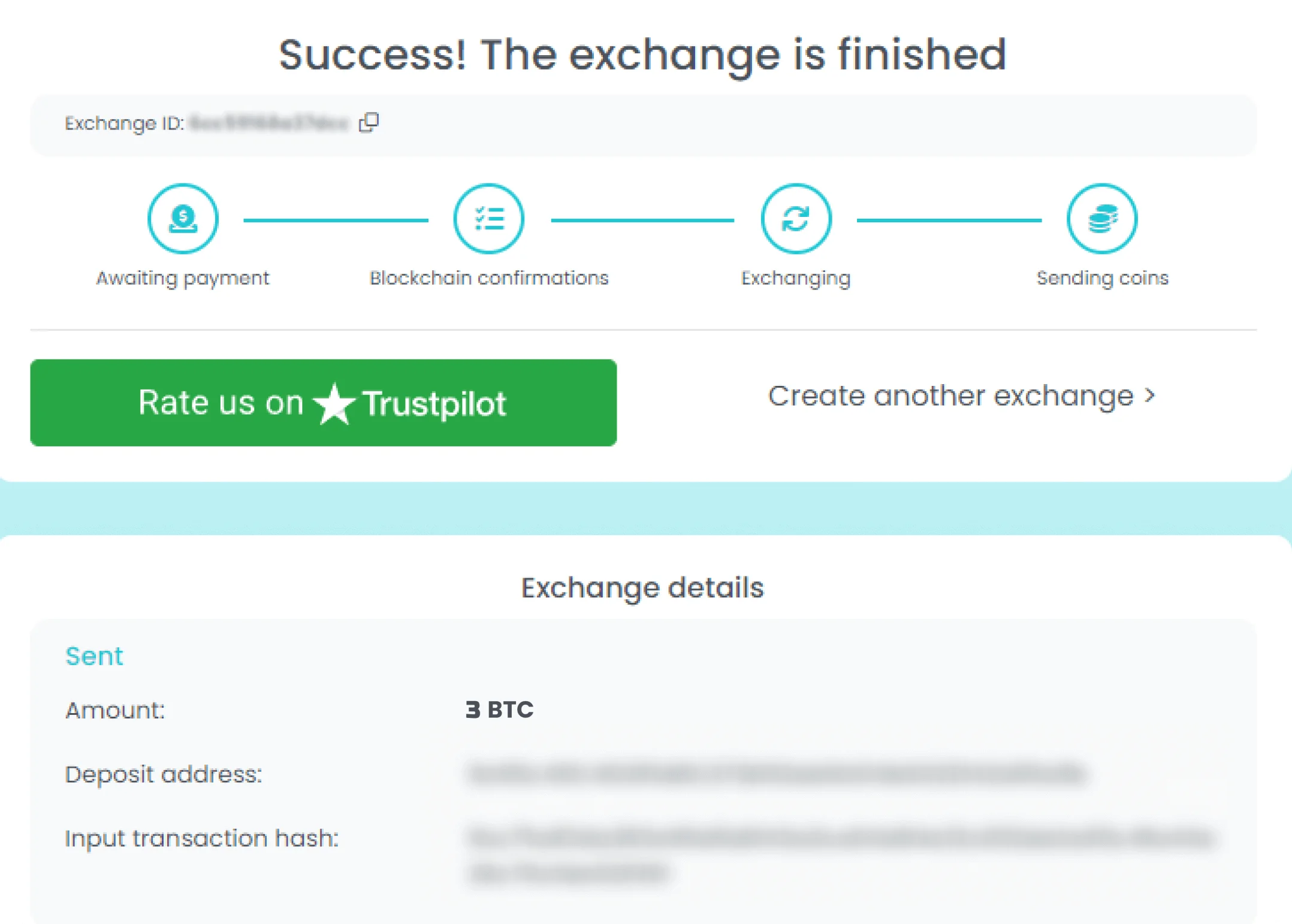

If you are looking to COMP exchange, you are in the right place. Swap Compound in a matter of minutes using Exchang.io crypto exchange. Just adhere to these 4 simple steps.

Benefits of Exchanging COMP on Exchang.io

Simple

We make sure not to overload our website with unnecessary elements. Only the things you need for smooth Compound conversions.Simple and clear.

Secure

Exchang.io is a safest place to exchange COMP. Get COMP anonymously, without KYC and registration.

In touch

Write to us in any unclear situation with COMP swaps. Our support team is happy to help you 24/7.

Fast

We are constantly upgrading our platform to make Compound exchanges really fast. The average speed for the swap is about 5-15 minutes.Popular Compound trading pairs

Here are some popular COMP trading pairs. You can buy COMP with every listed coin on Exchang.io.

How Much Compound Can I Exchange on Exchang.io?

Exchanging Compound on Exchang.io is unlimited. You can start swapping COMP right now starting from the lower limit of ≈ $3.

There are no upper limits for Compound exchanges at Exchang.io. Exchange Compound with other cryptocurrencies from the list of over 700 coins as much as you want to.

Cross-chain exchanges are available; just choose any coin on any network and click the Exchange button, and we'll do the rest for you

Why exchange Compound?

Things you will be able to do with exchanged COMP:

If you hold Compound cryptocurrency (COMP), there are several things that you can do with it.

First, you can use COMP to participate in governance decisions on the Compound platform. Holders of COMP tokens have voting rights and can propose changes to the protocol or vote on proposals submitted by others.

Second, you can earn interest by supplying your COMP tokens to the Compound platform as collateral. By doing so, you can also borrow other cryptocurrencies at a variable interest rate, which may be advantageous compared to centralized lending platforms.

Third, you can trade COMP on various cryptocurrency exchanges. COMP is listed on many popular exchanges, including Binance, Coinbase, and Kraken, making it easy to buy and sell.

Finally, you can store your COMP tokens in a cryptocurrency wallet, either a hardware or software wallet, for safekeeping and long-term investment. Just make sure to choose a reputable wallet provider and take appropriate security measures to keep your tokens secure.

What is Compound?

Compound is a decentralized finance (DeFi) protocol built on the Ethereum blockchain that allows users to earn interest on their cryptocurrency deposits and borrow other cryptocurrencies using them as collateral.

The Compound platform facilitates lending and borrowing of various Ethereum-based assets such as ETH, DAI, USDC, BAT, WBTC, and others. Users can earn interest by depositing their cryptocurrencies into one of the Compound's liquidity pools. Conversely, borrowers can use their digital assets as collateral to borrow other cryptocurrencies.

All transactions on the Compound network are executed through smart contracts, which means that the process is trustless and transparent. Compound uses an algorithmic interest rate model that adjusts interest rates based on supply and demand in the market.

The interest rates on Compound are not fixed, they fluctuate based on several factors, including the utilization rate of the asset, the current market demand for the asset, and the overall supply of the asset on the platform.

Compound's native token is COMP, which is an ERC-20 token that allows holders to participate in governance decisions related to the Compound protocol. COMP holders can vote on proposals to amend the protocol, including adjustments to interest rates and other parameters.

Compound has become one of the most popular DeFi protocols, with billions of dollars in total value locked (TVL) on its platform. Its popularity is due to the convenience it provides to users, allowing them to easily lend and borrow various cryptocurrencies without intermediaries.

Additionally, Compound's algorithmic interest rate model ensures that interest rates remain competitive and open to market forces, making it an attractive option for investors seeking high-yield returns on their cryptocurrency holdings.

However, like all DeFi protocols, Compound is not immune to risks. Smart contract bugs, market volatility, and liquidity risks are some of the potential risks associated with using Compound.

To mitigate these risks, users should exercise caution and perform their own due diligence before depositing their cryptocurrencies into the Compound protocol. Users should also be aware that using Compound may incur gas fees, which can be costly during times of high network congestion.

Overall, Compound is a revolutionary DeFi protocol that offers users the ability to earn interest on their cryptocurrency holdings and borrow other cryptocurrencies using them as collateral. Its algorithmic interest rate model and decentralized governance framework make it an attractive option for investors seeking high-yield returns and a voice in protocol decision-making.

However, users should be aware of the potential risks associated with using Compound and perform their own due diligence before participating in the platform.

Brief History of Compound

Compound (COMP) is an Ethereum-based decentralized finance (DeFi) protocol that allows users to earn interest on their cryptocurrency holdings and borrow assets from others. It was launched in September 2018 by Robert Leshner, a former economist at the Federal Reserve Bank of New York.

The idea behind Compound was to create a more efficient lending and borrowing system by removing intermediaries such as banks. Instead, users can lend or borrow directly from the Compound protocol, which uses smart contracts to automate the process.

The Compound protocol originally started with support for only two tokens: Ether (ETH) and Basic Attention Token (BAT). Over time, the protocol has added support for many other cryptocurrencies, including stablecoins like USDC, DAI, and Tether.

In June 2020, Compound announced the launch of its own governance token, COMP. Holders of COMP are able to vote on proposals related to the development and governance of the Compound protocol. The introduction of COMP helped to drive up the value of the token and sparked a wider interest in DeFi protocols.

After its launch, COMP quickly became one of the most popular DeFi tokens, reaching a market capitalization of over $1 billion within days of its release. This demonstrated the growing interest in DeFi and the potential of governance tokens to incentivize participation in decentralized ecosystems.

In July 2020, Compound launched its first liquidity mining program, which allowed users to earn COMP rewards for providing liquidity to the protocol. This helped to increase liquidity on the platform and further incentivized users to participate in the governance of the protocol.

Over time, the Compound protocol has continued to grow and add new features. In November 2020, it launched its Open Price Feed, which provides real-time price data to DeFi applications. In February 2021, it introduced Compound Treasury, a service that allows businesses and institutions to earn interest on their USDC holdings.

The value of COMP has fluctuated over time, but it has remained one of the most valuable DeFi tokens. As of June 2023, the market capitalization of COMP is over $1.5 billion and it is ranked among the top 100 cryptocurrencies by market cap.

Despite its success, the Compound protocol has faced some criticisms. Some have raised concerns about the centralization of power within the platform, as well as the potential risks associated with decentralized lending and borrowing systems.

Nevertheless, the Compound protocol has played an important role in the development of the DeFi ecosystem. Its innovative approach to lending and borrowing and its emphasis on community governance have inspired other projects in the space and helped to drive the growth of decentralized finance.

Compound Key Advantages and Unique Features

Cryptocurrencies have been rapidly evolving since the inception of Bitcoin in 2009. One trend that has emerged is the development of compound cryptocurrencies, which are designed to enhance the capabilities of traditional cryptocurrencies by adding new features and functionalities. Compound cryptocurrencies combine multiple cryptocurrencies or assets into a single token, providing users with enhanced flexibility and utility. Here are some key advantages and unique features of compound cryptocurrencies.

Firstly, compound cryptocurrencies enable users to diversify their cryptocurrency holdings by holding multiple assets in a single token. This reduces the need for users to manage multiple wallets and exchange fees. Additionally, it provides liquidity providers with an opportunity to earn rewards by contributing to the liquidity pools of these tokens.

Secondly, compound cryptocurrencies can increase the efficiency of decentralized exchanges (DEXs) by providing more liquidity. Liquidity providers contribute to the pools of these tokens, which helps in the price discovery process and ensures that traders can execute trades at competitive prices.

Thirdly, some compound cryptocurrencies offer unique features such as automated portfolio management, rebalancing, and yield optimization. These features can be particularly useful for investors who want exposure to different cryptocurrencies but do not have the time or expertise to manage their portfolios actively.

Fourthly, compound cryptocurrencies can potentially reduce the risk associated with holding individual cryptocurrencies. By combining multiple cryptocurrencies into a single token, users can reduce exposure to market fluctuations and other risks associated with individual cryptocurrencies.

Fifthly, some compound cryptocurrencies can offer enhanced privacy features by using advanced cryptographic techniques. For example, some tokens use zero-knowledge proofs to ensure that transaction details remain confidential.

Sixthly, compound cryptocurrencies can provide users with exposure to non-crypto assets such as gold or other commodities. This can be particularly useful for investors who want to diversify their portfolios beyond cryptocurrencies.

Seventhly, compound cryptocurrencies can potentially increase the adoption of cryptocurrencies by making them more accessible to mainstream users. Tokens that are backed by a basket of cryptocurrencies or assets can provide users with a more stable investment option, reducing the volatility associated with individual cryptocurrencies.

Finally, compound cryptocurrencies can incentivize blockchain developers to create new applications and platforms on top of existing blockchains. By providing developers with access to multiple cryptocurrencies or assets, compound tokens can facilitate the creation of innovative decentralized applications (dApps) that leverage the benefits of different blockchains.

In conclusion, compound cryptocurrencies offer numerous advantages and unique features that enhance the capabilities of traditional cryptocurrencies. As the cryptocurrency market continues to evolve, it will be interesting to see how compound cryptocurrencies evolve, and their adoption by mainstream users and investors increases.

10 Facts About Compound

Compound is a decentralized finance protocol that enables users to earn interest on their cryptocurrency holdings by lending and borrowing assets.

The Compound protocol is built on the Ethereum blockchain, and allows users to lend and borrow a wide range of cryptocurrencies including ETH, DAI, USDC, BAT, and more.

The interest rates on Compound are determined by supply and demand, with rates adjusted automatically based on the amount of funds available for lending and borrowing.

Users can earn interest on their cryptocurrency holdings by supplying assets to the Compound protocol, with interest paid out in the same currency as the asset supplied.

Borrowers on Compound can use their cryptocurrency holdings as collateral to borrow other assets, with interest rates based on the total amount borrowed and the current market conditions.

The Compound protocol uses a governance token called COMP, which allows users to vote on proposed changes to the protocol such as adding new assets or changing interest rate parameters.

COMP tokens are also used to reward users who participate in the protocol by lending or borrowing assets, with rewards distributed based on the amount of activity and the duration of participation.

The Compound protocol has been audited for security by multiple third-party firms, and has never experienced a major security breach or hack since its launch in 2018.

The team behind Compound includes experienced developers and entrepreneurs from the cryptocurrency and traditional finance industries, and the project has received backing from well-known venture capital firms.

The Compound protocol has been integrated into a wide range of cryptocurrency wallets and platforms, making it easy for users to access and participate in the protocol from anywhere in the world.

What is the Best Place to Exchange COMP?

Via Exchang.io service you can effortlessly swap Compound for over 700+ different assets. Begin by selecting COMP and your desired coin, paying attention to the network when making your choice. Next, provide the recipient's wallet address for the coin you're swapping to, and press 'Exchange' to continue. Deposit the required amount of COMP to the address displayed on the screen, ensuring you have the necessary amount to finalize the transaction. Once completed, check your wallet to confirm the arrival of your newly acquired coin. Exchang.io makes exchanging Compound simple and convenient, allowing you to enjoy a seamless experience with an extensive selection of coins to choose from.

Do I need to create an account on Exchang.io to swap Compound?

No, you don't have to create an account or provide any personal information. Exchang.io is a registration-free and ID verification-free service. It's easy to buy Compound with your crypto by following the simple steps on the platform.

How long does it take to exchange Compound on Exchang.io?

The exchange process on Exchang.io is super fast, taking only a few minutes to complete. However, network traffic and transaction confirmation times may slightly affect the actual time.

What is the minimum amount needed to swap comp on Exchang.io?

At present, there is a minimum amount required for Comp exchange on Exchang.io. The minimum amount may change over time, so it's best to check the platform for the latest requirements.

Is Exchang.io legit? Why should I trust Exchang.io?

Yes, Exchang.io is legit. Its team consists of experienced crypto enthusiasts who aim to make the platform convenient, fast, and transparent for users. To become even better, they closely monitor community feedback on social media. You can check the reviews on Exchang.io to learn more.

What are some popular trading pairs for Compound?

Exchang.io supports various Comp trading pairs, including Comp/BTC, Comp/ETH, Comp/LTC, and Comp/USDT, among others. These are some of the popular pairs used by traders on the platform.

Are cross-chain exchanges available for Compound?

Yes, Exchang.io supports cross-chain exchanges for Comp, enabling you to choose any coin from any network. Click the 'Exchange' button, and Exchang.io will handle the rest, making it easier for you to trade Comp across different chains.